热点栏目

热点栏目来源:市川新田三丁目

by Wolf Richter

The Fed stepped away from the market after its jawboning created the biggest bond bubble ever.

在用嘴皮子把美国债券市场的泡沫忽悠到前所未有的程度后,联储反而裹足不前了

The Fed started buying corporate bond ETFs for the first time ever in May and corporate bonds for the first time ever in June. These programs had been ballyhooed with enormous fanfare in the media – that the Fed would load up its Special Purpose Vehicles (SPVs) with $750 billion of corporate bonds and bond ETFs, including junk-bond ETFs.

五月份联储首次开始买进跟踪美国公司债市场走势的交易所交易基金,并在6月份首开买入公司债个券的先河。这些操作被媒体大肆鼓吹成联储将通过特殊目的实体等渠道买入7500亿美元的公司债和公司债交易所交易基金,甚至包括跟踪垃圾债走势的交易所交易基金。

These pre-announcements and announcements and announcements of expansions of prior announcements triggered the biggest corporate bond bubble and junk bond bubble in history before the Fed even started buying.

这些正式公告前的造势宣传、正式的公告以及对以往的公告所做的延伸解读给美国公司债市场以及垃圾债市场带来的是前所未有的泡沫,而美联储甚至还没来得及动手买债。

Bond prices surged and yields plunged and ETFs soared, and junk bonds soared and their yields plunged, and junk-bond ETFs soared as everyone was trying to front-run the Fed’s massive purchases.

不管是公司债还是垃圾债,个券和交易所交易基金的报价均在大幅上涨,收益率猛降,每个人都想抢在联储动手之前先下手。

So the Fed accomplished its handiwork – creating a bond bubble and bailing out asset holders during the worst economy of in a lifetime – mostly by jawboning, and actually bought very small amounts of bonds and bond ETFs through July. It really just dabbled in them.

就这样,联储的阴谋得逞了,在美国实体经济正在遭受有生以来最糟糕局面的同时,美国公司债市场却正在经历一场巨大的泡沫,资产持有者的困局解脱了。而联储基本上只是动了动嘴,实际上到7月份为止只买了很少一点公司债的现券和跟踪公司债走势的交易所交易基金,联储只是“蜻蜓点水”般地介入了一小下。

But then Tuesday afternoon, the Fed disclosed that over theperiod of July 31 through August 31:

但随后联储在本周二下午披露了7月31日至8月31日期间的公司债持仓情况:

1. It bought no bond ETFs– and I mean, zero, none, zilch, nada, null. And its spreadsheet was devoid of the usual entries of names, tickers, CUSIP numbers, dates, and mounts. Instead, it said, “No purchases were made over the current reporting period.” The Fed had not bought a single share of anything, not even symbolically. Screenshot of the spreadsheet:

联储在此期间没有买入跟踪美国公司债走势的交易所交易基金,注意:我说的是一分钱也没买。在联储公布的电子表格中发行人、债券简称、统一证券代码、买入日期和金额等常见条目下没有任何细节,只有一句话“在本报告期内没有买入”。联储没有买入一丁点的债券,连象征性地买入也没有。下面是该表格的截屏:

2. Its bond ETF holdings actually fell by $64 million,or by 0.7%, over the period through August 31, to a total of $8.67 billion, as the market value of these ETFs ticked down a smidgen.

在截止到8月31日的本报告期内,联储持仓的公司债交易所交易基金的总量实际上还减少了6400万美元,也就是0.7%,余额为86.7亿美元,原因是这些公司债交易所交易基金的市场估值下滑了一点。

This ETF debacle comes after the Fed had only bought $520 million in bond ETFs in July,in a sign that it was already winding down this operation.

在这一凄凉景象发生之前的7月份,联储只买了5.2亿美元的公司债交易所交易基金,这一迹象说明联储已经开始减少其买入公司债的力度了。

3. It bought almost no corporate bonds– and I mean, just a minuscule $456 million with an M, of corporate bonds, which by Fed standards – having tossed out the number $750 billion with a B and measuring its balance sheet in Trillions with a T – is not even a rounding error.

联储几乎没怎么买公司债的个券。我的意思是只买了4.56亿美元的公司债个券,与联储宣称的将买入7500亿美元的公司债以及资产负债总量动不动就以万亿美元来衡量相比,这4.56亿美元甚至都不够四舍五入的。

4. Its holdings of corporate bonds ticked up even lessbecause about $21 million of previously purchased bonds matured and were redeemed by the companies, and the total balance of its corporate bond holdings increased over the period by only $435 million, to a total of $3.99 billion.

联储的公司债持仓量的增幅甚至还没有上面提到的买入量多,因为在以前买入的公司债中有约2100万美元的公司债在本报告期内到期并被发行人赎回,公司债个券的持仓量在此期间内只增加了4.35亿美元,余额为39.9亿美元。

The Fed’s total corporate bond and bond ETF holdings rose by only $370 million over the period, to $12.66 billion – a far cry from the hoped for $750 billion.

在此期间,联储持有的美国公司债以及公司债交易所交易基金的总量只上升了3.7亿美元,余额为126.6亿美元,远低于7500亿美元的预期买入额。

The Fed’s jawboning had done all the heavy lifting. It created enthusiasm for even risky bonds, and the Fed, by just using its “communication tools,” as it likes to say, was able to manipulate the entire bond market into a frenzy.

联储的忽悠起到了四两拨千斤的作用,市场信以为真,激情四射得甚至恨不得连高风险的债券品种也收入囊中,而联储所动用的只是 “沟通手段”而已,联储很喜欢用这个词,就足以让整个债券市场陷入癫狂。

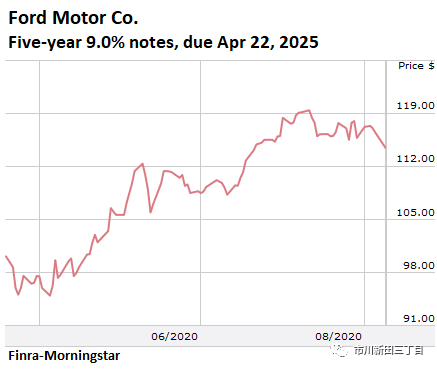

For example, the junk-rated Ford Motor Co. bonds show how little the Fed bought, inconsequential amounts essentially, but those bonds soared anyway, and the yields plunged, thanks to jawboning.

下面以垃圾债评级的福特汽车的公司债为例,看看联储购债的金额是少到什么程度,,但这么一点可以说是微不足道的购入量就令福特汽车的公司债来了个暴涨,收益率狂泻,联储的忽悠功夫就是高。

The Fed holds $15.5 million in bonds issued by Ford Motor Co., spread over two bonds, a two-year note and a five-year note, that Ford issued on April 22, 2020. The Fed accumulated its position in various smallish trades over time. Ford is junk rated because it had enormous problems and huge lossesbeforethe Pandemic, and then the Pandemic made everything a whole lot worse.

联储持有两只福特汽车的公司债,总额1550万美元,分别为两年期和五年期,发行日期为2020年4月22日。联储持仓福特汽车的公司债是分批买入的,每次买入的金额很小。福特汽车属于垃圾债评级,因为该公司问题多多,在新冠疫情到来之前就已经巨额亏损了,之后新冠疫情的爆发让整个局面变得更加不可收拾。

The Ford five-year 9.0% notes, CUSIP number 345370CW8, traded at a yield of 10.2% shortly after being issued on April 22. Then, amid announcements and hope-mongering about the Fed’s entry into the corporate bond market, the price began to surge and the yield began to drop.

福特汽车9.0%票息,美国统一证券代码为345370CW8的五年期公司债在4月22日发行后不久的二级市场收益率为10.2%,随后在联储宣布将买入公司债以及被购债承诺掀起来的激情推动下,该券的报价开始大涨,收益率大跌。

One of those trades in the five-year 9.0% notes, according to the Fed’s data disclosed a month ago, took place on July 2 for $2.2 million. The Fed paid 109.2 cents on the dollar. The bonds then soared to 119 cents on the dollar by August 10, for a yield of 4.3%. That’s less than half of the yield in April! Since then, the bond has backtracked and on Tuesday closed at 114 cents on the dollar, for a yield of 5.39%. (Chart viaFinra-Morningstar):

福特汽车在一个月前公布了一笔联储买入这只五年期、票息9.0%的公司债的细节,联储是在7月22日买入了220万美元的该券,买入价为面值为的109.2%。到了8月10日,该券的报价暴涨至面值的119%,到期收益率为4.3%,比4月份的收益率水平低了一半还多!之后,该券的价格出现回落,本周二的收盘价为面值的114%,收益率为5.39%。

This shows how powerful the Fed’s tool of jawboning is. And it also shows that the Fed doesn’t think it’s necessary to drive the credit market bubble any further. Fed Chair Jerome Powell has explained this many times – that the Fed has succeeded in achieving its objective of creating loose credit market conditions. It has in fact succeeded in blowing this bubble in the shortest amount of time, and the Fed itself is perhaps stunned by the magnitude of the bubble and its own success. And it stopped buying ETFs in July, and it trimmed it corporate-bond purchases to near nothing.

这个例子证明了联储的忽悠水平有多么高明,但也说明联储认为没必要把信用债市场的泡沫搞得再大一些。联储主席鲍威尔对此多次阐明过,联储在改善美国信用债市场融资状况方面已经达到了预期的目标。联储实际上是在非常短的时间内就把信用债市场的泡沫吹起来了,连联储自己也被这个泡沫膨胀的速度以及自己的忽悠如此之成功搞怕了。联储从7月份开始不再继续买入美国公司债交易所交易基金,购买公司债个券的金额也被减到近乎为零。

版权及免责声明:凡本网所属版权作品,转载时须获得授权并注明来源“融道中国”,违者本网将保留追究其相关法律责任的权力。凡转载文章,不代表本网观点和立场。

延伸阅读

版权所有:融道中国