热点栏目

热点栏目来源:中国石化新闻网

中国石化新闻网讯 据油价网利雅得报道,世界最大的原油生产和出口公司沙特阿拉伯国家石油公司 (沙特阿美)首席执行官阿明·纳赛尔日前在利雅得表示,沙特阿美对亚洲原油需求复苏的步伐持乐观态度,这将有助于推动油价上涨。

纳赛尔是在沙特阿美周末发表第二季度业绩报告以后在一份声明中发表上述讲话的。他表示,“由于世界各国采取措施放松限制并重振经济,我们正在看到能源市场出现部分复苏。”

彭博社援引纳赛尔的话报道说,亚洲对原油的需求几乎已恢复到疫情爆发前的水平。

纳赛尔在6月底曾表示,石油市场最糟糕的时期已经过去,并指出他对今年下半年的前景“非常乐观”。

纳赛尔在两个月前在CERAWeek会议上曾对IHS Markit副董事长Daniel Yergin表示,6月全球石油日需求量约为9000万桶,高于4月份的7500万-8000万桶。

分析师表示,沙特阿美8月9日有关需求复苏的言论是导致8月10日早些时候油价上涨的关键原因之一。

来自全球航班跟踪服务公司Flightradar24的数据显示,8月7日,全球商业航班数自3月20日以来首次超过7万次,这是对需求乐观的另一个迹象。然而,与去年8月同一周五相比,商业航班数仍下降了43.6%。

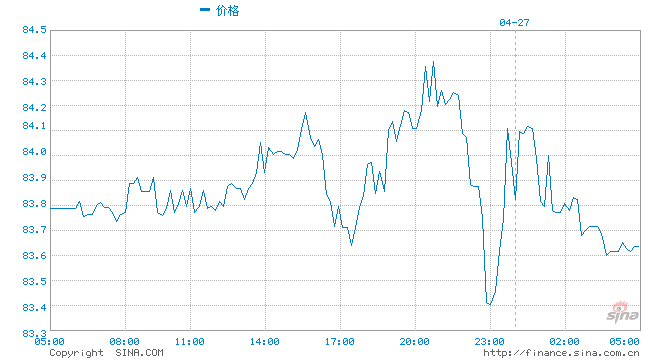

在经历了周五(8月7日)的下跌后,10日早些时候油价有所上涨,截至美国东部时间10日上午9点47分,美国基准原油交易价超过了2%。WTI原油上涨了2.28%,报收于每桶42.21美元,布兰特原油价格在45美元上方交易,报收于45.20美元,当日上涨了1.76%。

李峻 编译自 油价网

原文如下:

Saudi Aramco: Asian Oil Demand Recovery Almost At Pre-Crisis Levels

The world’s biggest oil-producing and oil-exporting company, state oil giant Saudi Aramco, is optimistic about the pace of oil demand recovery in Asia, chief executive Amin Nasser said on Sunday, helping oil prices rise.

“We are seeing a partial recovery in the energy market as countries around the world take steps to ease restrictions and reboot their economies,” Nasser said in a statement following Aramco’s Q2 report released over the weekend.

Demand for crude oil in Asia has almost returned to the levels from before the pandemic, Bloomberg quoted Nasser as saying.

At the end of June, Nasser said that the worst in the oil market was over, and noted that he was “very optimistic” for the second half of this year.

In June, global oil demand is somewhere around 90 million barrels per day (bpd), up from 75-80 million bpd in April, Nasser told IHS Markit Vice Chairman Daniel Yergin in an interview for CERAWeek Conversations two months ago.

Saudi Aramco’s comments on Sunday about the demand recovery were one of the key reasons for oil prices rising early on Monday, according to analysts.

In another sign of optimism about demand, data from global flight tracking service Flightradar24 showed on Saturday that on Friday, August 7, there were more than 70,000 commercial flights globally for the first time since March 20. Yet, the number of commercial flights was still down 43.6 percent compared to the same Friday in August 2019.

After a drop on Friday, oil prices rose early on Monday, with the U.S. benchmark up more than 2 percent as of 9:47 a.m. EDT. WTI Crude rallied 2.28 percent at $42.21 and Brent Crude was trading above $45—at $45.20, up by 1.76 percent on the day.

版权及免责声明:凡本网所属版权作品,转载时须获得授权并注明来源“融道中国”,违者本网将保留追究其相关法律责任的权力。凡转载文章,不代表本网观点和立场。

延伸阅读

版权所有:融道中国